Thelander CVC Digest: February 2025

Why Are Corporate Shares Essential in CVC Units?

| Join J.Thelander Consulting, Cooley and Echo Health Ventures for a CVC Compensation Panel Webinar next Thursday, March 6th from 10:00 – 11:00 am PST. Can’t join us live? RSVP to secure the recording. |

Welcome to this month’s Thelander CVC Digest. Corporate shares represent a unique facet of compensation exclusively available within CVC units. What makes them so special? Unlike other investment firms, only CVC units can leverage corporate shares from the parent company as part of their compensation packages, making them particularly appealing when the parent company thrives.

Let’s delve into the allocation of corporate shares based on data from the Thelander CVC Compensation Survey. Corporate shares are typically distributed through one of the following methods:

- Stock options

- Performance-based stock options

- Restricted stock units

Now let’s explore the trends and implications of these compensation structures within CVC units.

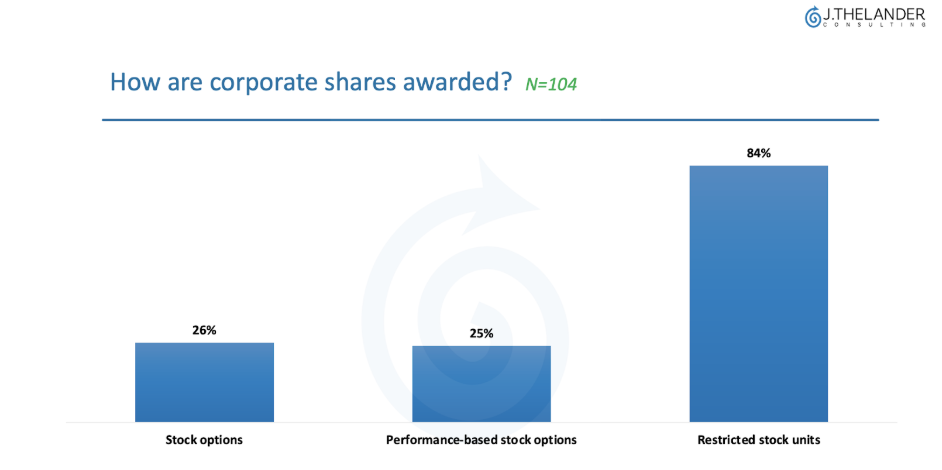

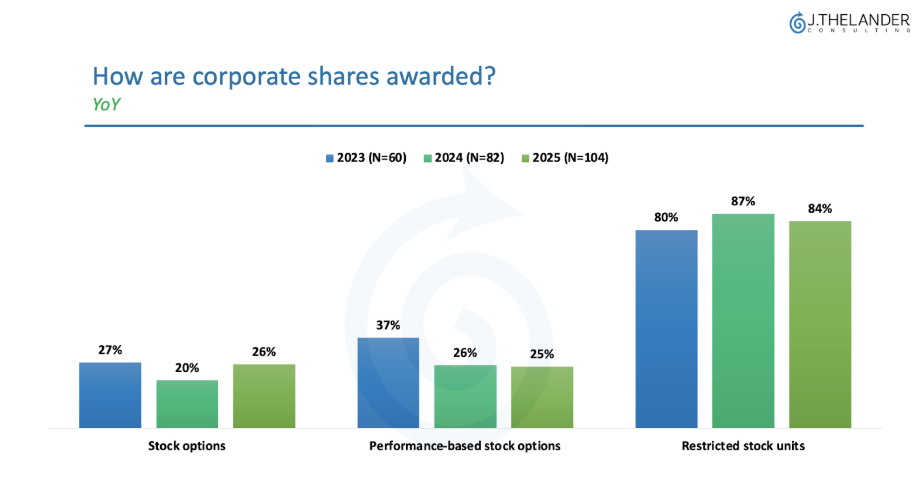

Chart 1 & 2 look at how corporate shares are awarded. We see the following:

Stock options decreased in popularity in 2024, with a slight recovery in 2025 but still below 2023 levels.

Performance-based stock options have steadily declined in popularity since 2023.

Restricted stock units increased in popularity in 2023 but dropped below those levels in 2024.

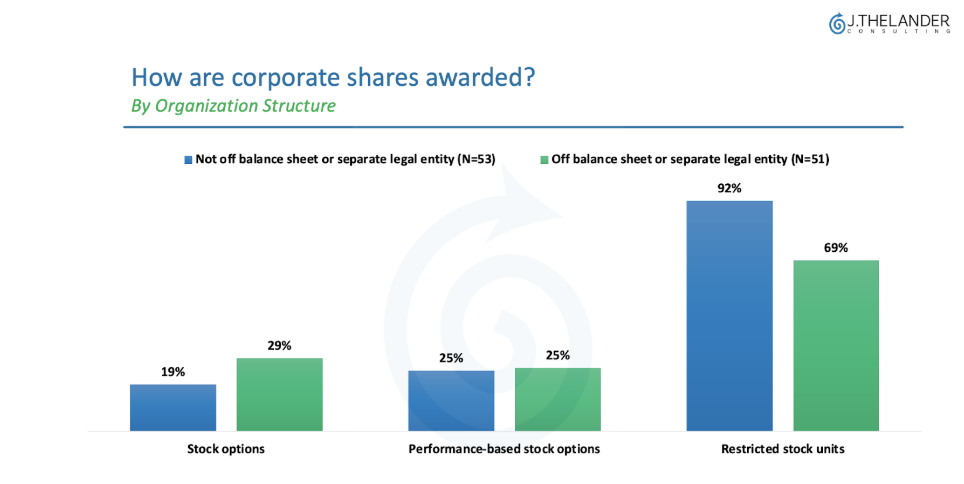

Chart 3 looks at how corporate shares are awarded by organization structure. We see the following:

Off Balance Sheet Units:

Stock options are more common.

Restricted stock units are less common.

On Balance Sheet Units:

Restricted stock units are more common.

Stock options are less common.

What’s the bottom line?

Understanding long-term incentives can be complex, as highlighted in our previous digests. Utilizing corporate stock as a long-term incentive offers stability that is an exclusive benefit available to CVC units. This unique advantage makes it a compelling tool for attracting top talent from traditional venture capital firms while the vesting times for carried interest are extending.

Participate in the CVC Compensation Survey For More Compensation Data

Did you know we offer a detailed report on corporate stock and carried interest on our platform? Current subscribers can download it directly. If you’re not yet a subscriber but interested in real-time, comprehensive and quality data and analysis, participate in our CVC Compensation Survey today to start your trial and discover what sets our platform apart. To see what’s included in your free subscription, schedule a demo.

Tags: CVC, Newsletter