Thelander IF Digest: February 2025

What’s the Payoff for Being on an Advisory Board?

Welcome back to the Thelander Digest for Investment Firms. Many of our readers are busy on boards or compensation committees for their portfolio companies so we recommend subscribing to our Private Company Digest for additional insights pertinent to your portfolio companies.

We understand the value of both being on a board, providing crucial strategic guidance, industry expertise, and valuable networks to portfolio companies as well as the value of having an advisory board member, who serves as an indispensable partner in steering investment firms towards smarter decisions and enhanced returns.

We’re excited to announce the release of our inaugural report on advisory board member compensation – inspired by a client inquiry. If there is a question or job title you’d like to be included, send us an email or respond to this digest.

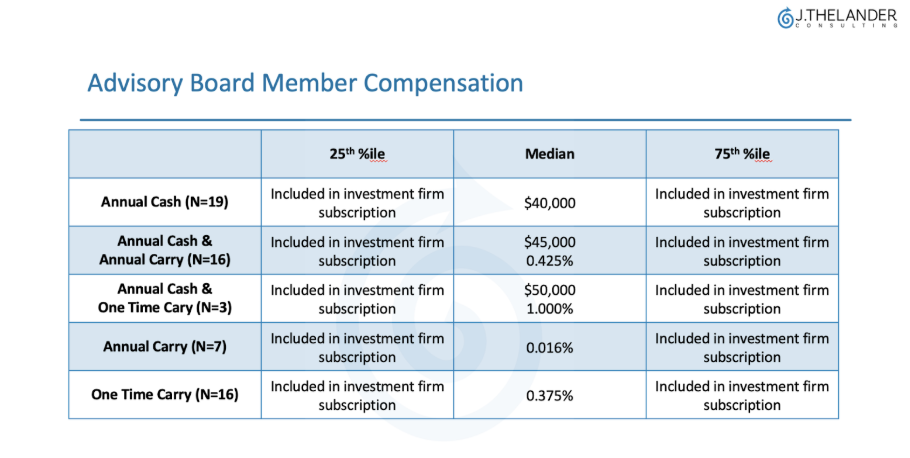

Let’s dive into the compensation options for advisory board members. These roles can be remunerated through various combinations, including:

- Annual Cash

- Annual Cash & Annual Carry

- Annual Cash & One-Time Carry

- Annual Carry

- One-Time Carry

The predominant method of compensation is annual cash only. The other frequent compensation is one-time carry. The other most popular option is the combination of annual cash and one-time carry.

Table 1 looks at advisory board member compensation. We see the following:

- Median Cash Compensation: $40,000

- One-Time Carry: 0.375%

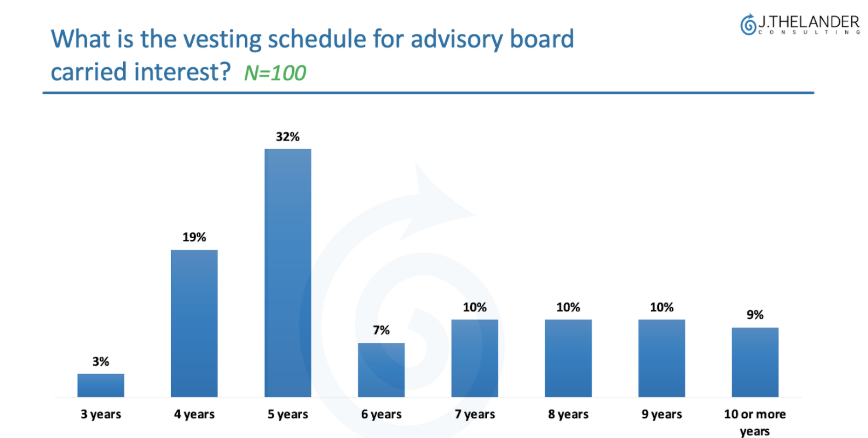

Chart 2 looks at the vesting schedule for advisory board carried interest. We see the following:

- Vesting Period for Advisory Board Members: Most commonly around 5 years.

- Comparison with Investment Professionals: Vesting period for advisory board members is shorter compared to the 8 to 10 years for investment professionals.

- Importance of Vesting: Ensures commitment and aligns the advisory board’s interests with the firm’s strategic goals.

What’s the bottom line? Effective implementation of an advisory board is crucial, and getting the compensation right is key. To explore our platform and access a subset of compensation data for free, participate in the Thelander-PitchBook Investment Firm Compensation Survey. This will grant you 12 months of complimentary platform access. Plus, by participating, you’ll secure discounted pricing for full access, should you wish to obtain the complete advisory board member report for your firm.

For current paid subscribers interested in the full report, please respond to this email, and a Thelander team member will contact you directly. If you’re considering subscribing and wish to learn more, we invite you to schedule a call or demo with us.

Tags: Investment Firm, Newsletter