Thelander PC Digest: February 2025

What Does Your Equity Really Mean for Your Private Company?

Ensuring the right equity distribution in privately held companies is key. Access to real-time, quality market data helps accurately benchmark and determine competitive equity allocations for your team in relation to cash compensation. Equity, typically vested over four years with a one year cliff, is THE long-term incentive exclusive to private companies. It not only drives potential wealth creation but also aligns the team with investor interests, crucial for sustained success.

As your company evolves, particularly with ongoing capital raises, the balance between cash and equity compensation will change. Understanding these dynamics is essential.

Jenn Fang, Partner at Wilson Sonsini, elaborates on the types of equity awards common in private companies, how they vary across industries, and change with company growth stages in this excerpt from the latest private company compensation panel webinar. The full recording is on our platform, accessible through survey participation or a paid subscription.

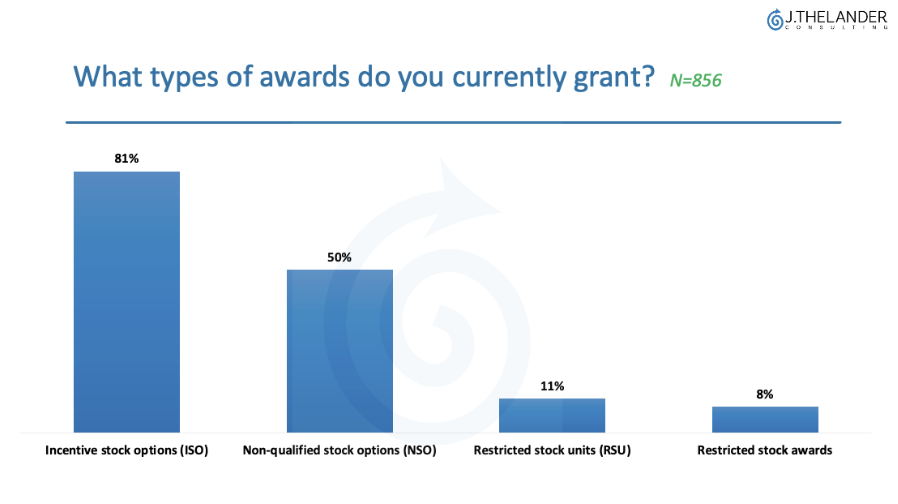

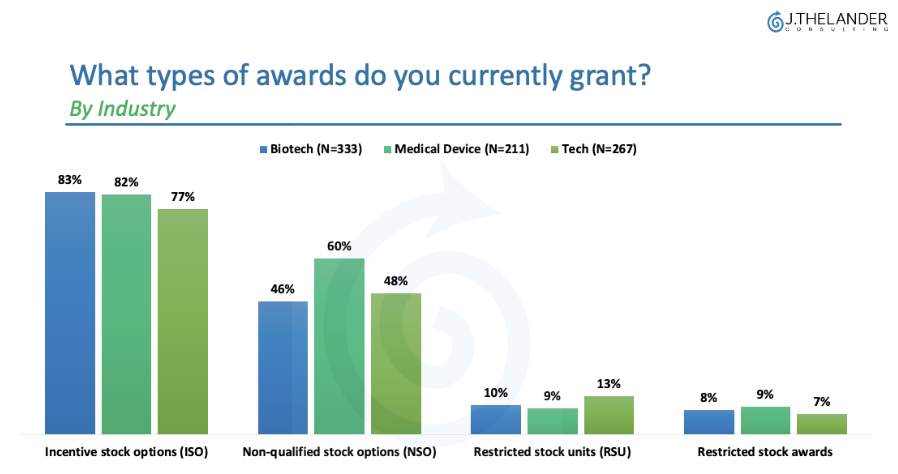

Chart 1 & 2 look at what types of awards are being granted. We see the following:

Incentive Stock Options: Most popular form of equity awards granted across all industries.

Restricted Stock Units: Favored by tech companies over biotech or medical device companies.

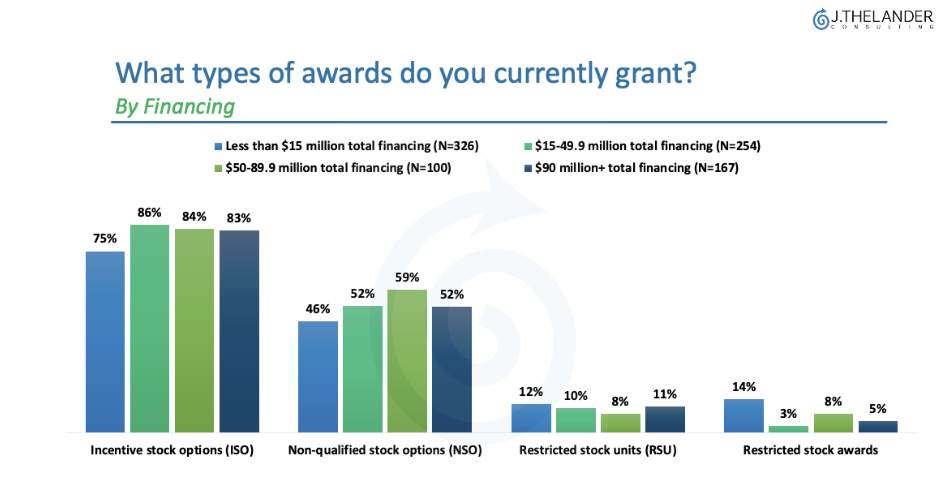

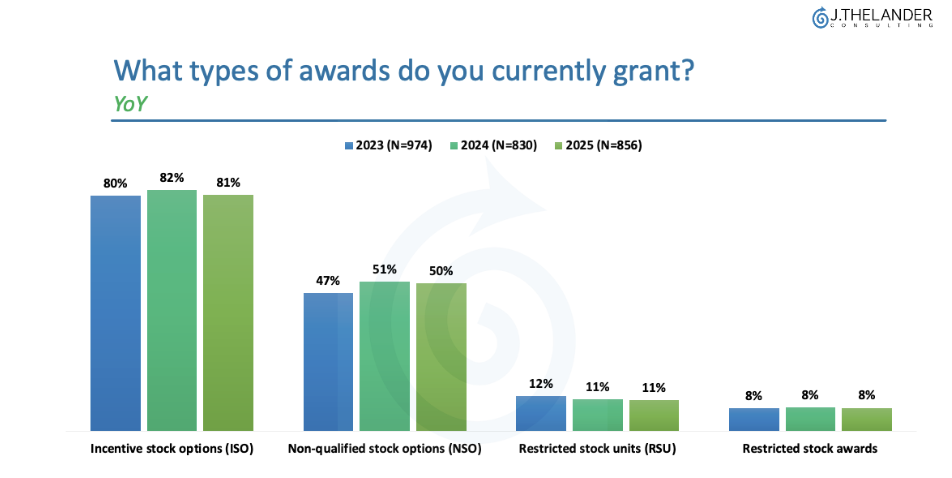

Chart 3 & 4 look at what types of awards are being granted by financing and YoY. We see the following:

Restricted Stock Awards: Most popular among companies that have raised less than $15 million.

Incentive Stock Options: Become the preferred choice after the $15 million fundraising mark, remaining popular up to $90 million.

What’s the bottom line? Understanding the specifics of your equity—how much you own and how its owned—is crucial. We recommend benchmarking equity based on the percentage of fully diluted shares rather than the absolute number of shares to gain an accurate picture of what you own. Additionally, the type of equity award you hold can significantly influence your tax implications, as different awards are subject to varying tax treatments.

Participate in the Thelander Private Company Compensation Survey For Cash / Equity Data

The Thelander Digest is powered by the Thelander Private Company Compensation dataset. To trial our platform and see the depth and breadth of Thelander data for yourself – participate in our surveys here. Why participate?

There is no cost to participate and when you complete your survey response, you secure FREE access to real-time comp data for the next 12 months.

Thelander data is specific to the unique needs of private companies – no public company comp included.

We cover all your compensation needs from non-investor board comp, option pool, salary increases, change of control, severance and more.

We have customizable job architectures for your staff-level employees that can also include job matching.

Tags: Newsletter, Private Company