Thelander CVC Digest: September 2024

Where are CVCs Sourcing their Top Talent?

In this issue, we explore trends in the recruitment landscape of Corporate Venture Capital. Understanding where talent is coming from and what attracts them helps CVCs refine their recruitment strategies and stay competitive in acquiring top talent.

So where are CVCs sourcing their top talent? Let’s dive into the data.

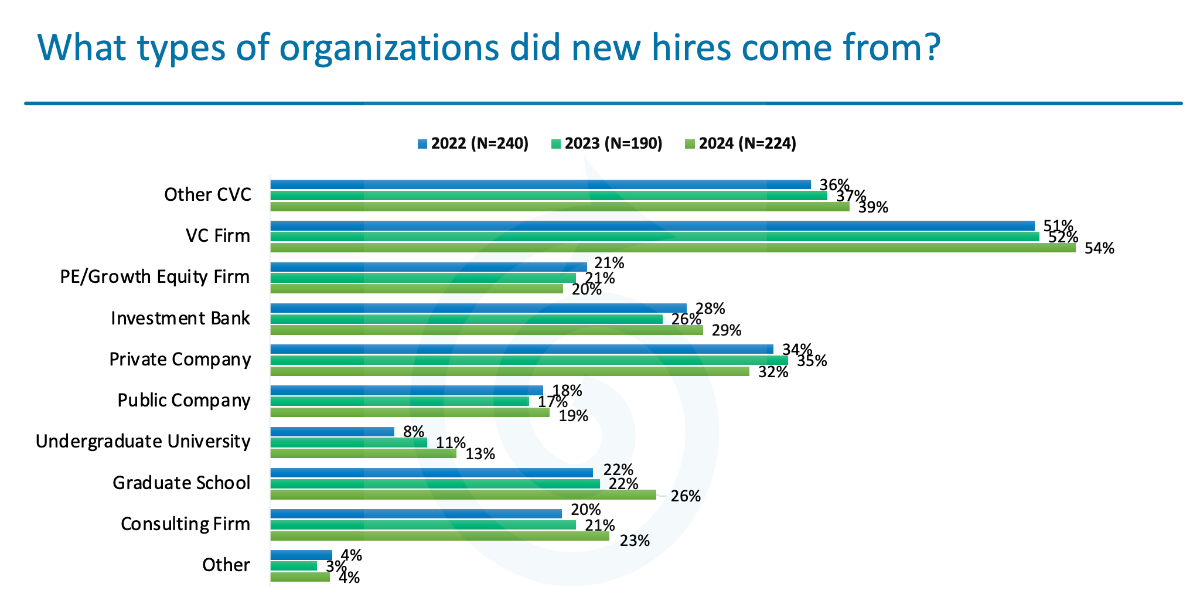

Chart 1 shows what type of organizations new hires came from. We see the following:

Increasingly Popular Sources: New hires are increasingly coming from other CVC firms, VCs, investment banks, and educational institutions (undergrad and grad schools), as well as consulting firms.

Decreasingly Popular Sources: Fewer hires are coming from private equity/growth sectors and private companies.

Stable Sources: Public companies remain a relatively stable source of new hires.

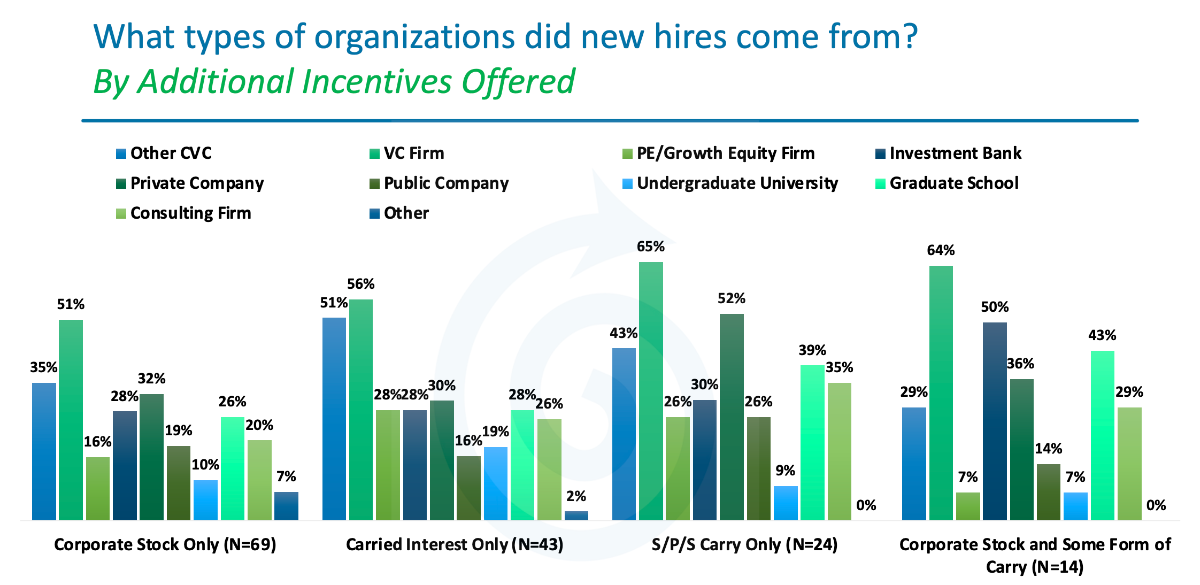

Chart 2 shows what type of organizations new hires came from by additional incentives offered by the CVC Unit. We see the following:

Shadow/phantom/synthetic (SPS) Carry and Combo Incentives: The firms that offer these models attract the highest percentage of new hires from venture capital firms, although VC firms are the most common source across all incentive types.

Carry Only: This incentive type offered by CVC Units primarily attracts talent from other VC firms.

Investment Banks: 50% of new hires in CVC units that offer combined incentives (SPS Carry or Combo) come from investment banks, making it the second most common source.

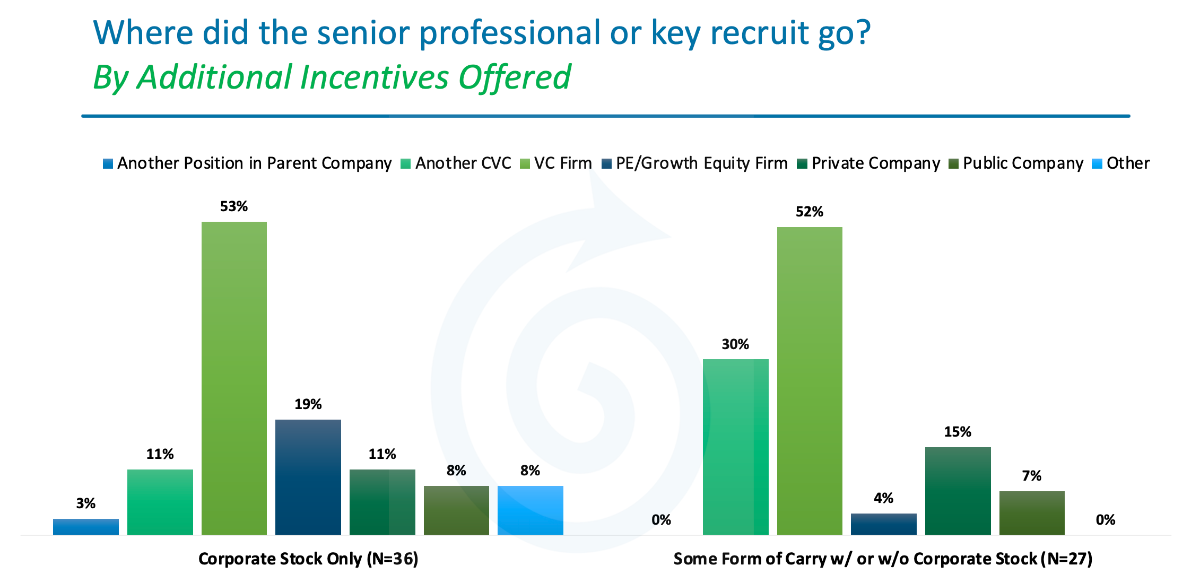

Chart 3 shows where the talent is going. We see the following:

Equal Opportunity: Units are equally likely to lose professionals to VC firms as they are to recruit from them.

Corporate Stock Only Units: CVC Units are more likely to lose talent to private equity/growth firms and less likely to lose to other CVC units.

The Bottom Line:

The data highlights that the structure of incentives significantly shapes the CVC recruitment landscape. Companies with a combination of SPS Carry and Corporate Stock, as well as those offering only carry, are more likely to attract candidates from venture capital and investment banking sectors. These trends indicate a clear preference for certain incentive structures over others in attracting top talent.

Participate in the Thelander CVC Compensation Survey for FREE Comp Data Today

The Thelander Digest is powered by the CVC Compensation Survey. We invite you to secure free compensation data for traditional investment firms and corporate venture firms for the next 12 months by completing your response today. Find out why thousands of the world’s top venture capital, private equity firms, family offices, CVC Units and their portfolio companies rely on Thelander’s real-time data and premier services to level up their compensation game.

To see what’s included in your free subscription, schedule a demo. You can also reach us by phone at +1.305.793.8605

Tags: CVC, Newsletter