Thelander IF Digest: September 2024

How Carry Dollars at Work Impacts Investment Firm Compensation

This month, we focus on the dynamics of carry dollars at work and how it shapes the compensation strategies across various investment firms. Understanding carry dollars at work—a crucial compensation lever—is essential for gauging potential returns on carried interest, which in turn helps with strategic planning and in attracting/retaining top talent.

Carry dollars at work is defined as the potential carry in dollar amount an individual might receive if their funds achieve a 2x gross multiple. This measure gives a clear view of what might be earned from successful fund performance, making it a valuable metric for investment professionals.

So what is the impact of carry dollars in investment firm compensation? Let’s dive into the data.

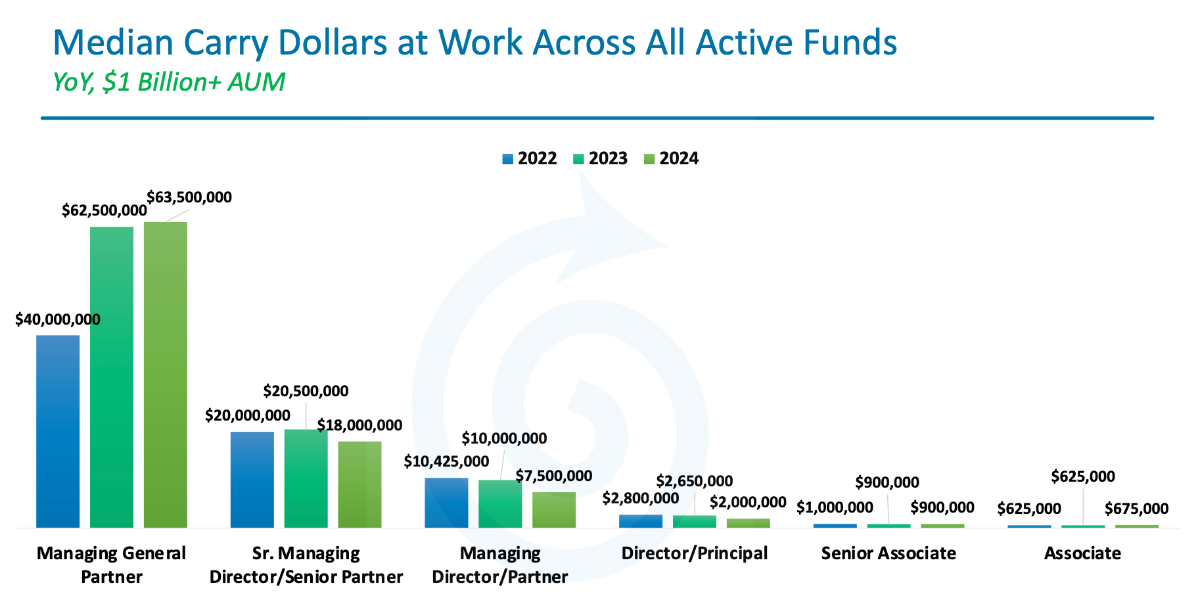

Chart 1 shows median carry dollars at work across all active funds with an AUM of more than $1 Billion. We see the following:

Managing General Partners saw an increase in the median carry dollars at work from 2022 to 2024 – reinforcing the high earning potential at senior levels.

Decrease in Senior Roles: Senior Managing Directors/Sr. Partners, Managing Directors/Partners, and Director/Principal roles have seen a decrease in median carry dollars at work since 2022.

Stable for Competitive Roles: Carry dollars at work have stabilized for roles like Senior Associates and Associates, indicating a steady compensation landscape at these levels.

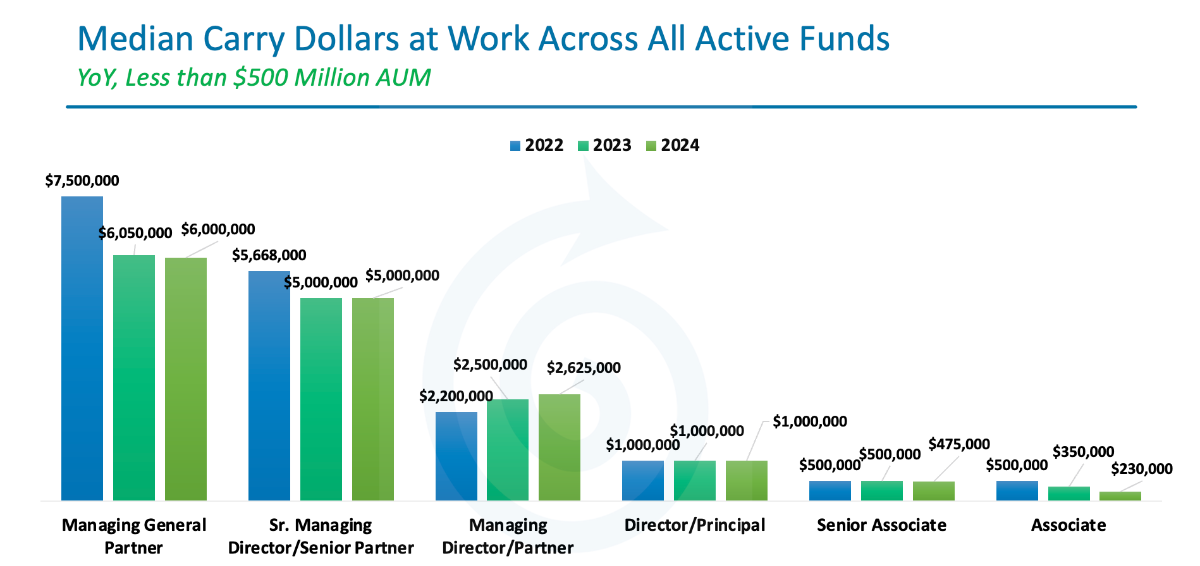

Chart 2 shows median carry dollars at work across all active funds with an AUM of less than $500 Million. We see the following:

Decrease for Managing General Partners and Sr. Managing Directors/Sr. Partners: Median carry dollars at work decreased for Managing General Partners since 2022 from $7,500,000 to $6,005,000 in 2023 and $6,000,000 in 2024. For Sr. Managing Directors, carry dollars at work decreased from 2022 but stayed the same from 2024.

Increase at Junior Levels: Managing Director/Partner saw an increase in carry dollars at work since 2022 – moving from $2,200,000 to $2,625,000 at the median.

Stability in Lower Ranks: Similar to larger funds, compensation remained stable or slightly decreased for Director/Principal, Senior Associate, and Associate roles.

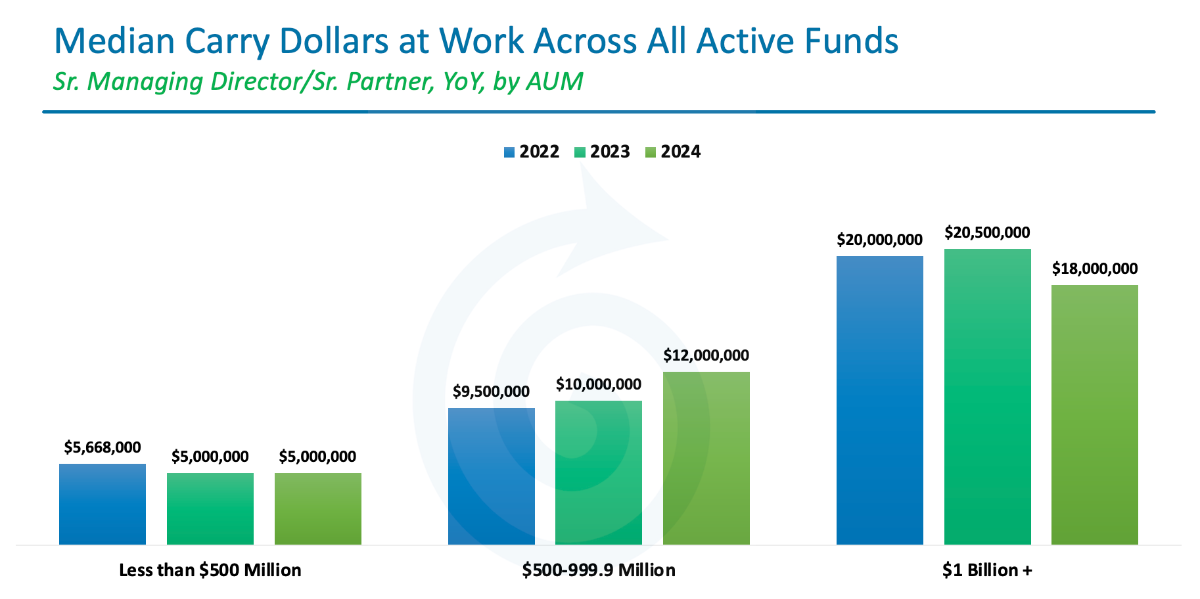

Chart 3 shows median carry dollars at work across all active funds for Sr. Managing Directors/Sr. Partners based on AUM. We see the following:

Stability Under $500 Million: Sr. Managing Directors/Sr. Partners have seen stable carry dollars since 2022 in firms with under $500 Million AUM.

Growth in Mid-Sized Funds: There was a significant increase in carry dollars for Sr. Managing Directors/Sr. Partners in the $500 Million to $999.9 Million AUM bracket.

Decrease in Largest Funds: However, the data shows a decrease in median carry dollars at work for Sr. Managing Directors/Sr. Partners in firms with over $1 Billion AUM.

The bottom line:

According to PitchBook, “US venture fund returns remain negative but are trending up once again, a hopeful sign for a struggling fundraising market after a sustained period of portfolio markdowns.” This shift suggests a crucial moment for investment firms to reevaluate their compensation strategies, including around carry dollars at work.

The full carry dollars at work report and data are available through a paid subscription to the Thelander online platform. You can trial the platform and access a free subset of data by participating in the Thelander-PitchBook Compensation Survey today. Or you can schedule a demo to view what’s included and get your specific comp questions answered for your firm and/or portfolio companies.

Participate in the Investment Firm Compensation Survey For Real-Time Salary Data

Tags: Investment Firm, Newsletter