Thelander CVC Digest: May 2024

The Goal of Your CVC Unit Impacts Compensation

Welcome back to the May edition of our Thelander Digest. Last month, we talked about how long term incentives are impacted by CVC unit structure. This month, we’re going to focus on another key factor – the goal of the CVC Unit and how that impacts long and short term incentives.

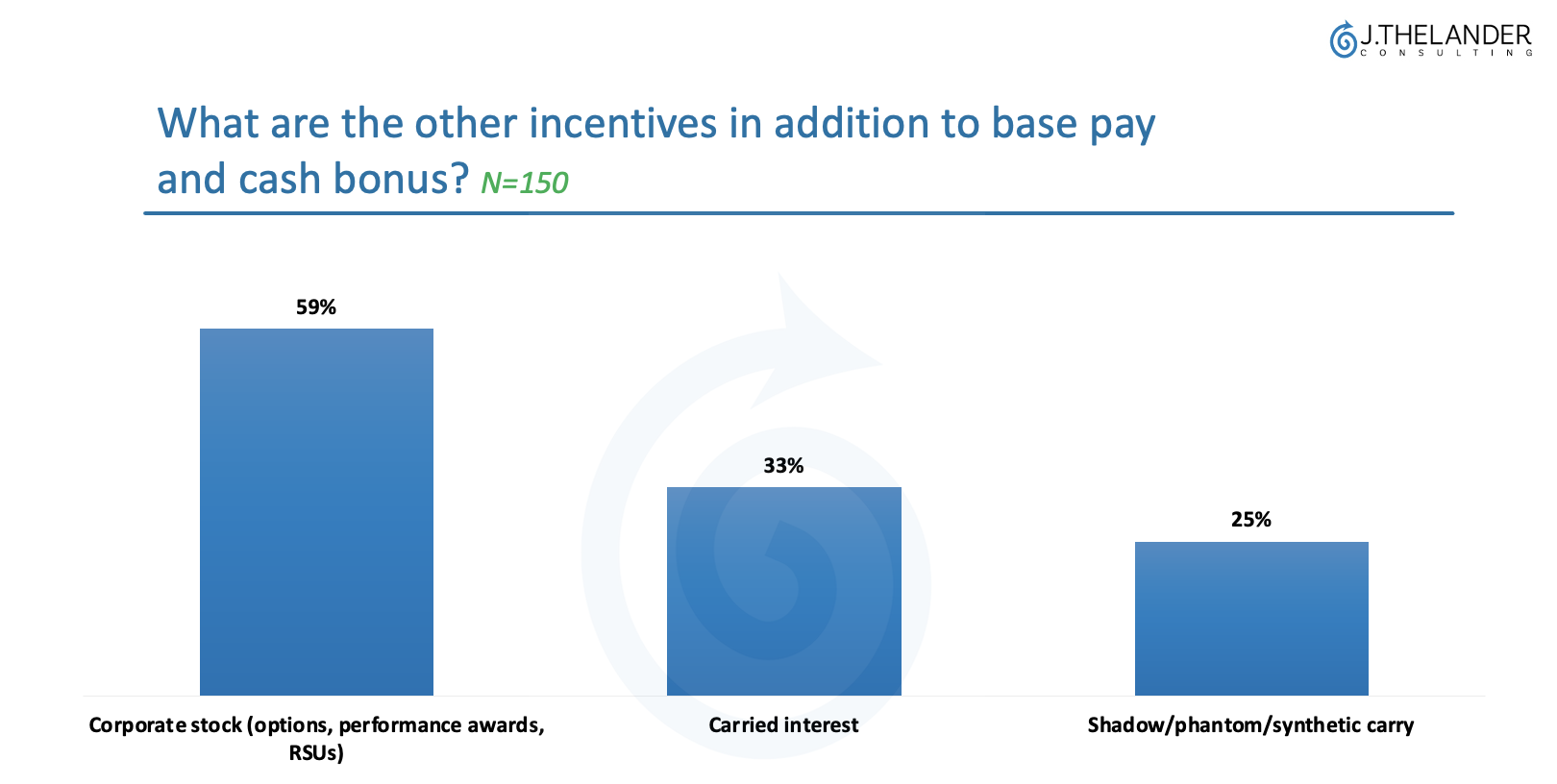

In addition to base pay and cash bonus (short term incentives), there are several ways for CVCs to incentivize their employees. That includes long term incentives such as corporate stock, some form of shadow/phantom carry or a mix of both. However, the first question you need to ask yourself when setting up your CVC Unit is, “what is the intended goal of the fund?”

If the goal is to mirror what’s happening within the parent company and create value, it makes sense to reward employees within your CVC unit with some form of corporate stock, such as options, performance awards or RSUs, because you’re working towards the same goal. According to data from the Thelander CVC Compensation Survey, 66% of CVCs offer corporate stock only.

On the flipside, if the goal of your CVC is to operate outside of the core business or to make investments that are unrelated to generating revenue or creating a financial return for the parent company, some form of carry, such as carried interest or shadow/phantom/synthetic carry could be a better choice. With these incentives, employees on the investment team have skin in the game and are invested in the success of the fund. According to data from the Thelander CVC Compensation Survey, 22% of CVCs offer some form of carry, down from the high of 32% recorded in 2022.

There is an upside for employees to have corporate stock in their compensation mix. Corporate stock is typically paid out annually and the vesting period is much shorter than the vesting time for carried interest. Plus, if your parent company has a well-performing stock, this can result in favorable earnings for your team. However, some would argue carry offers more upside, despite having longer vesting periods and more risk, it is a trade-off.

The typical vesting period for carry can be anywhere from five to 10 years, which is increasing as private companies take longer to exit. But, if a CVC fund has a significant return, that can mean big money for the team with some version of carry. Again, creating more incentives for employees to perform well and stick around longer, which benefits both the CVC unit and portfolio companies.

No matter what the goal for the CVC Unit is, alignment within the parent company is key to making the best compensation decisions for your unit, and Thelander has the data and expertise to help you get it right.

The Thelander Digest is powered by the no-cost Thelander CVC Compensation Survey – open year round. We invite you to participate and secure free access to a subset of the results for 12 months on our platform. All data is published in aggregate only with no individual names or firm names reported. If you have any questions or would like to schedule a demo to see what’s included in your free subscription, you can do so here or call us: +1.305.793.8605

Tags: CVC, Newsletter