Thelander CVC Digest: March 2024

Long Term Incentives: What You Need to Know

Welcome back to the Thelander Digest. This month, we are going to share first-hand what comes up on the consulting side of the business regarding long term incentives for CVC Units.

Here’s what you need to know:

- In addition to cash compensation, which includes base salary and bonuses, many CVCs are focused on how to include long-term incentives for their investment teams.

- Corporate stock has historically been the most common incentive, but there is more of an appetite for some version of carry, similar to what traditional venture capital firms use.

- Some CVCs have attempted traditional carried interest, but this is complicated because of the different LP/GP structure. This is where phantom/shadow/synthetic carry gets introduced, which has been increasing in popularity.

Why is a long term incentive important?

Investors are tied to the success of their portfolio companies. CVC Units typically have not had skin in the game in the same way that venture capital firms do because they do not raise a fund from outside LPs or contribute capital for carried interest. That relates directly to compensation because the risk/reward model is different. Yet the desire for CVC Unit Leaders, investment professionals and their teams to have a long-term incentive that correlates to the success of their investments is real. We see increasing pressure on corporate HR to address this issue and incorporate some version of carry.

Using another compensation lever, such as shadow/phantom/synthetic carry, corporate stock or even carried interest, allows the team to accomplish this. This is especially true for certain titles, like investment professionals and BD roles. Teams are more incentivized to ensure the portfolio companies are doing well if they know they’ll share in the benefits of their eventual success.

So, what really is the difference between corporate stock, carried interest and shadow/phantom/synthetic carry? And, which is best for your CVC Unit?

- Corporate Stock: Equity in the parent company, e.g., options, performance awards or RSUs.

- Carried Interest: A direct share in fund profits as in a typical GP/LP structure.

- Shadow/Phantom/Synthetic Carry: A “proxy equivalent” for carried interest. It can be calculated by a change in fair market value of the portfolio or a % of a return from portfolio “exits”.

Now, let’s have a look at how these trends play out across CVCs using Thelander data.

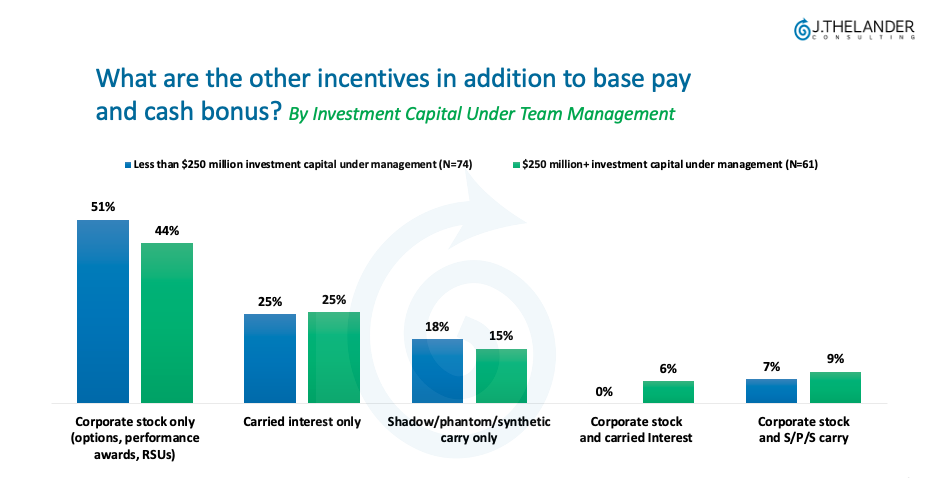

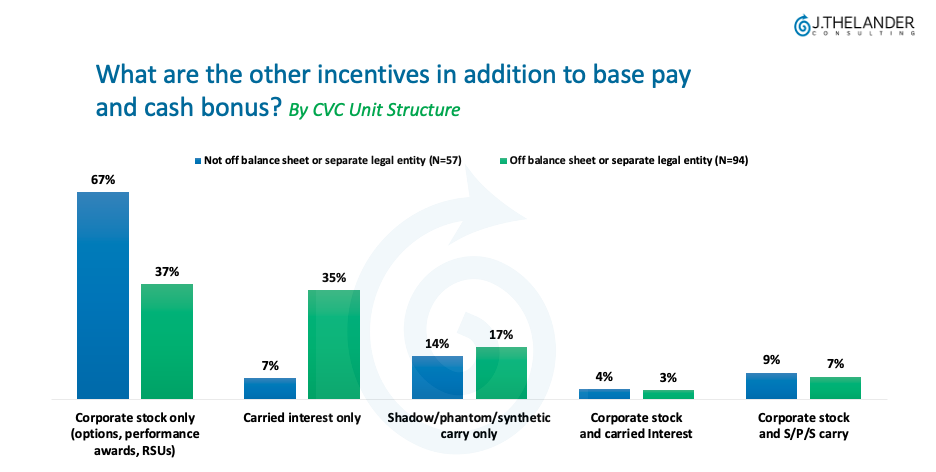

More than half (51%) of CVCs with less than $250 million of investment under team capital under management (AUM) offer corporate stock only, along with 44% of CVCs with more than $250 million in AUM. A quarter of all CVCs offer carried interest only and we’re seeing a growing number of CVCs offer shadow/phantom/synthetic carry only (18% for smaller CVC units and 15% for larger CVC units). Others are experimenting with a mix of corporate stock and carried interest or a mix of corporate stock and shadow/phantom/synthetic carry – more common among larger CVC units.

The CVC Unit Structure and investment capital under team management (AUM) impacts what other long term incentives are utilized.

Jody Thelander, Founder and CEO, leads consulting projects to help CVC units design and review their compensation structures, including base salary, current and target bonus, and long term incentives. To learn more about our data and consulting services, you can email or call us: +1.305.793.8605

The Thelander Digest is powered by the CVC Compensation Survey. We invite you to take less than 20 minutes (if you haven’t done so already) to input your data and secure your complimentary silver subscription. There is no cost to participate and all respondents receive free access to a subset of compensation data. All data is published in aggregate only with no individual names or firm names reported.

Tags: CVC, Newsletter