Thelander CVC Digest: September 2023

Has Vesting for Long-term Incentives Changed?

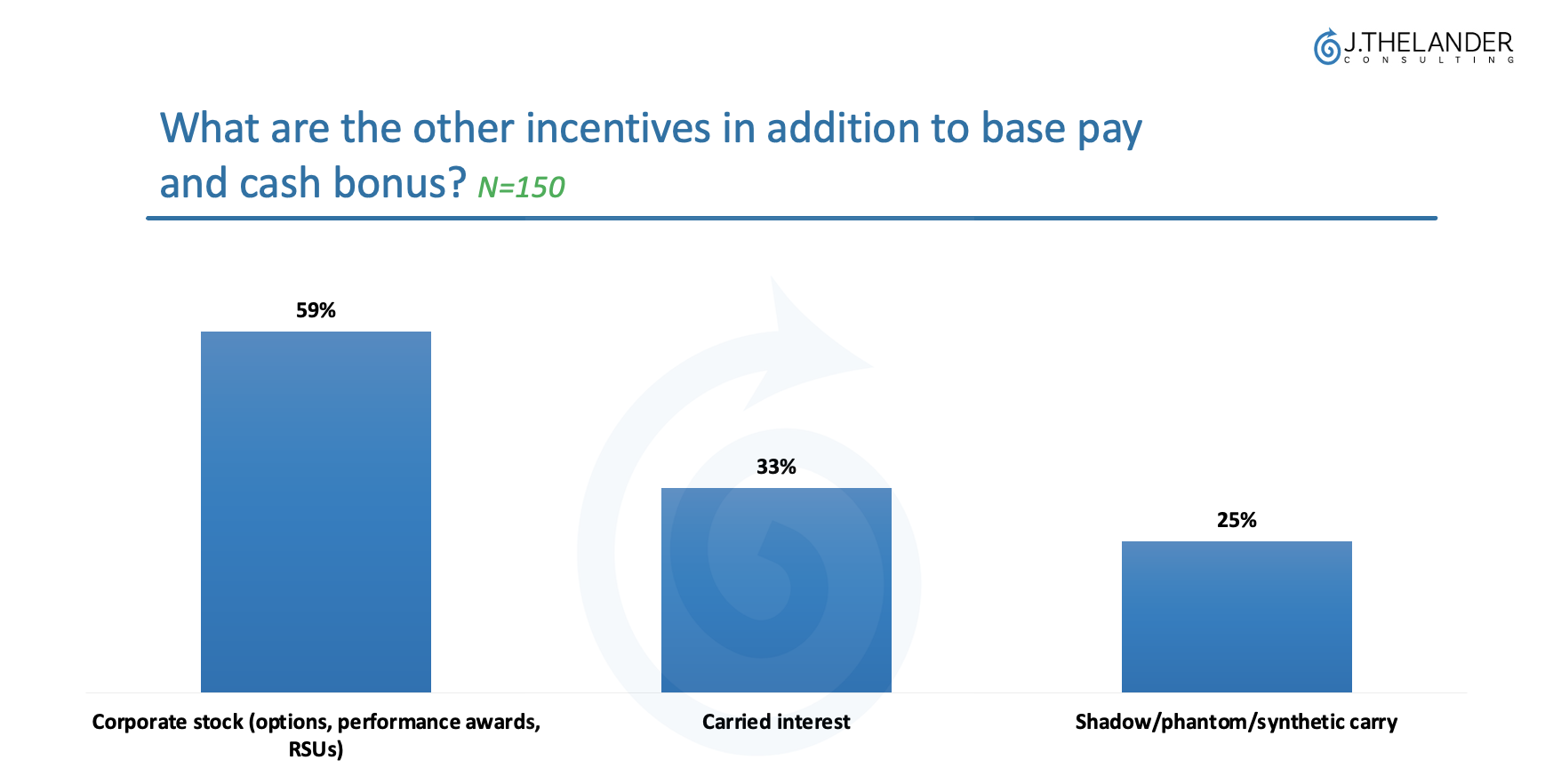

Welcome to September’s Thelander Digest, where we’ll explore how vesting for long-term incentives has changed since last year. The first chart looks at what other (long-term) incentives in addition to base pay and cash bonus are utilized by CVC Units. The most popular option is corporate stock, followed by carried interest and shadow/phantom/synthetic carry. Let’s dig into the data!

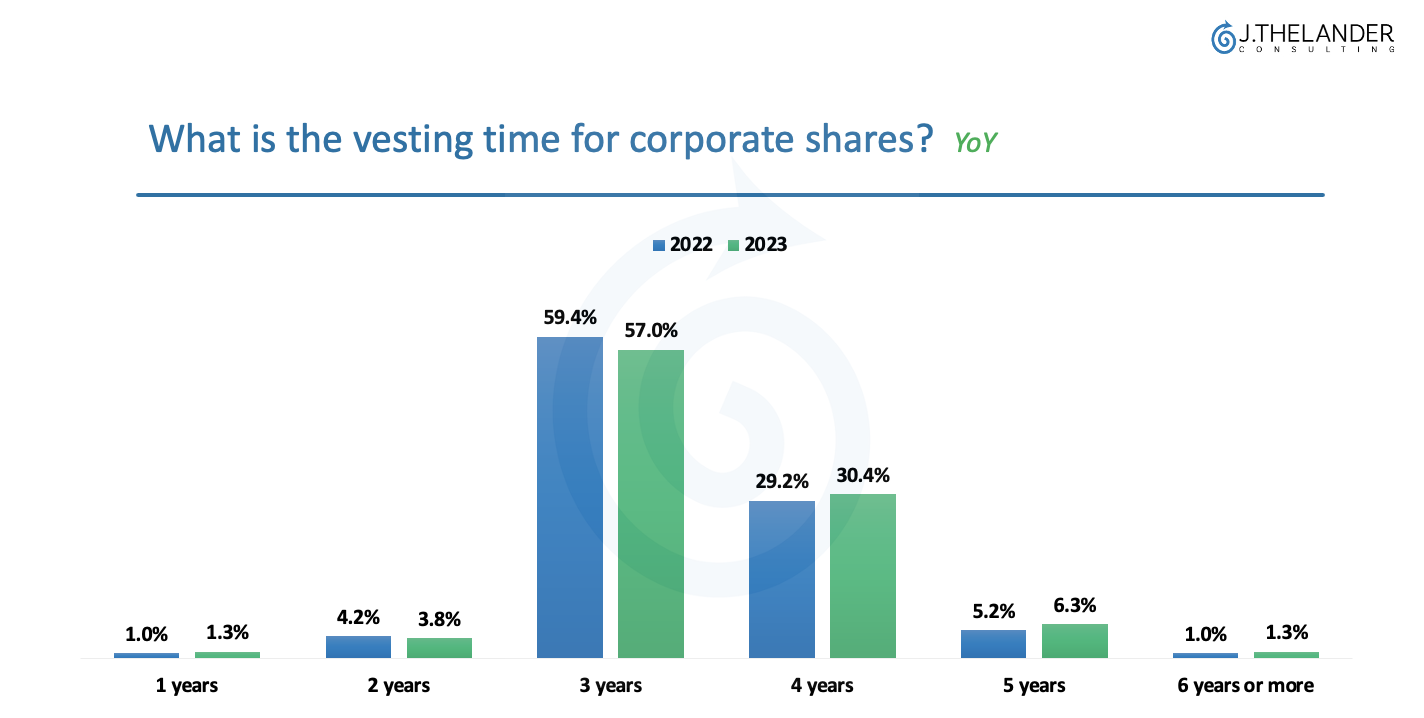

Chart 2 shows the vesting time for corporate shares.

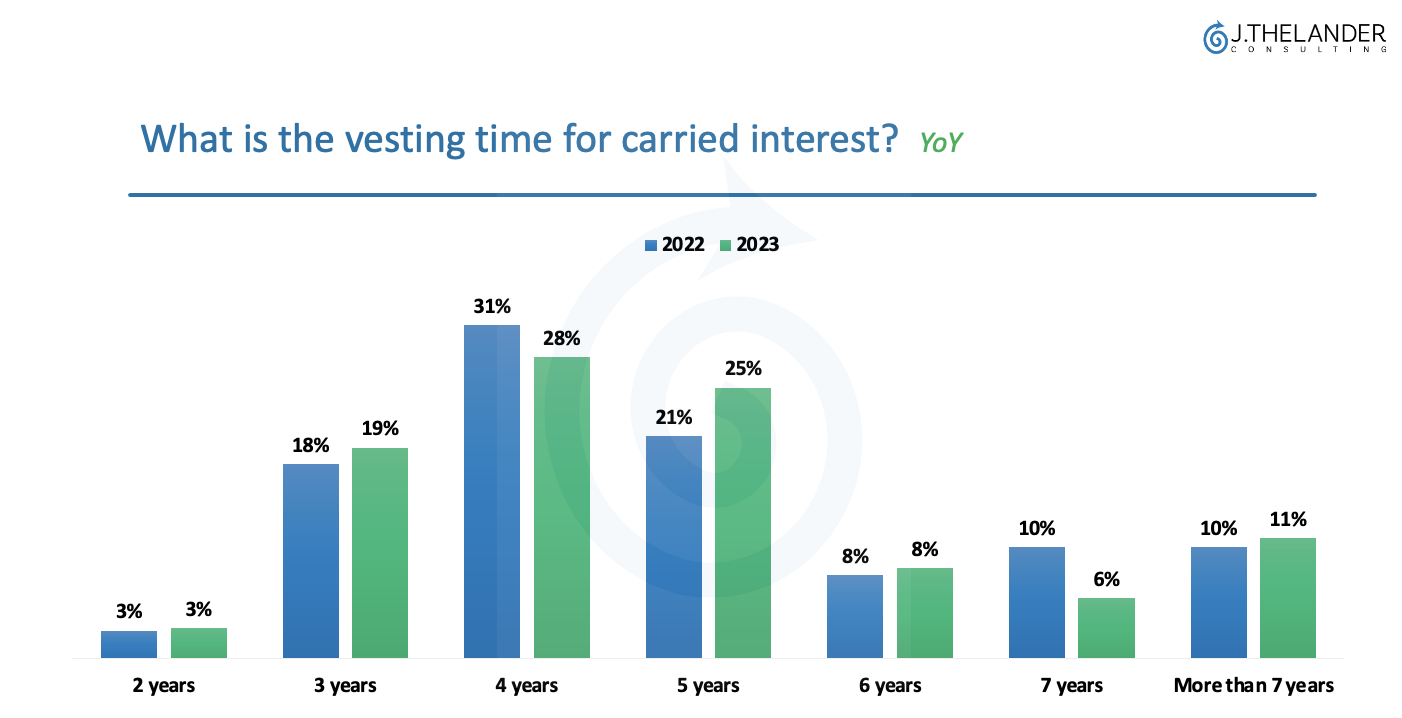

Chart 3

shows the vesting time for carried interest.

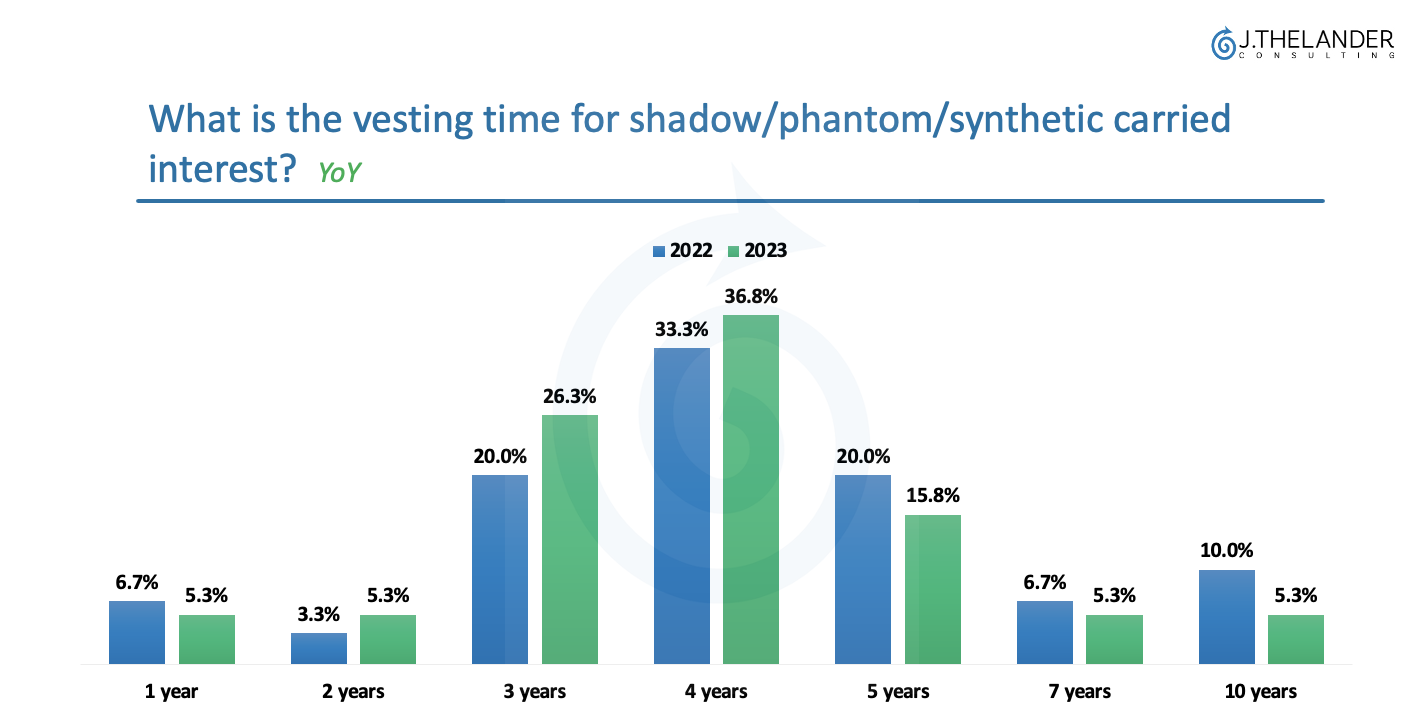

Chart 4 shows the vesting time for shadow/phantom/synthetic carried interest.

Our Findings:

- Vesting time for corporate shares is leaning towards getting longer. “3 years” has decreased from 59.4% to 57.% while “4 years” has increased from 29.2% to 30.4%

- Carried interest is also getting longer with the most popular option – “4 years” – decreasing 3% from 2022. “5 years” increased 4%.

- Last.. but not least….shadow/phantom/synthetic carried interest. The biggest increases from 2022 can be seen in the “3 year” and “4 year” categories – while “5 years” has decreased from 20.0 to 15.8%

Want more compensation data? Participate in the CVC Compensation Survey Today

Tags: CVC, Newsletter