Thelander CVC Digest: February 2023

Is Carried Interest on the Rise for CVC Units?

In February’s Thelander Digest, we explore if carried interest is on the rise for CVC units. By examining the graphs below that illustrate our data from

the Thelander Investment Firm-CVC Compensation Survey, we explore notable trends.

| The Thelander Digest is powered by real-time compensation data from the Thelander Investment Firm-CVC Compensation Survey. There is no cost to participate and all respondents will receive free access to a subset of the results through a silver level subscription. |

Get More Compensation Data: Participate in the CVC Compensation Survey Today

By examining the Thelander data on carried interest for CVC units, some key takeaways:

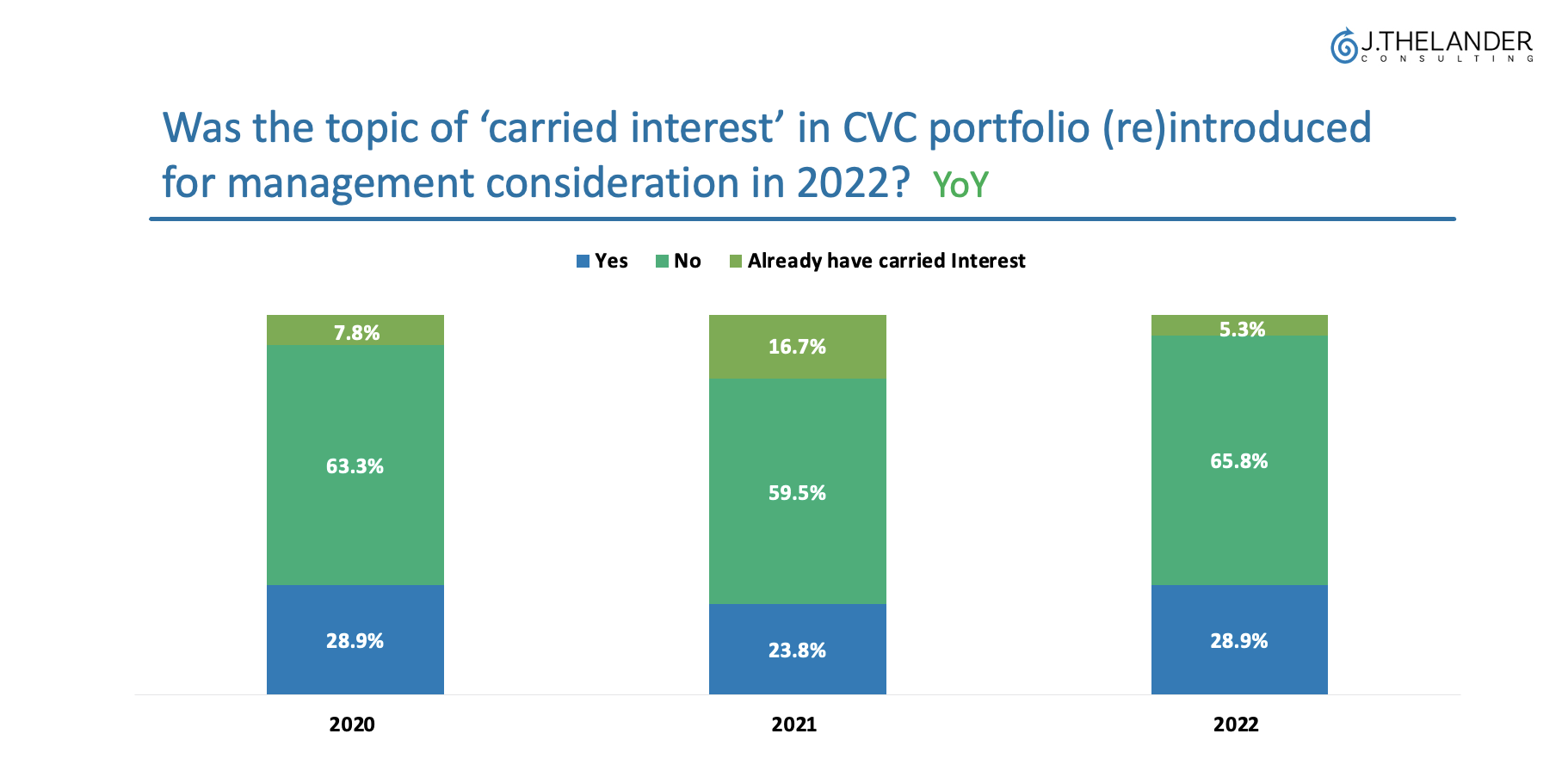

- In 2022, 28.9% of CVC firms reported that they were re-introducing carried interest to management. This was the same percentage seen in 2020.

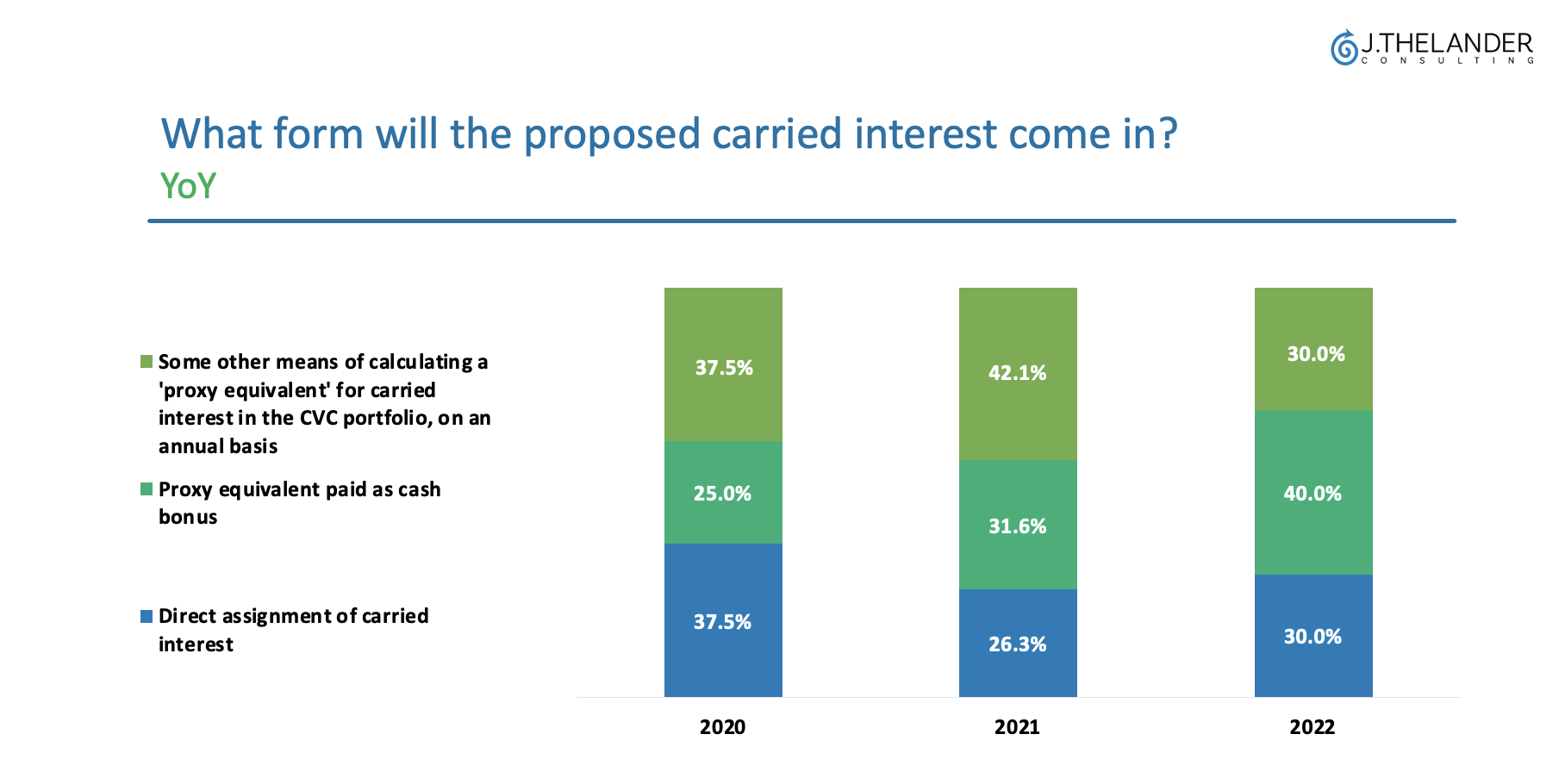

- Of the firms re-introducing carried interest, 30.0% of them are proposing a direct assignment of carried interest, followed by proxy equivalent paid as cash bonus. This was more popular for 2022 compared to for 2021 or 2020.

Thelander is the only firm that covers the entire private capital market from your investment firm to your portfolio company’s compensation. Did you enjoy our Thelander Digest, have ideas for future ones, or want to learn more about how J.Thelander Consulting can help you make informed decisions when it comes to hiring, incentivizing, and retaining talent? Email us here or give us a call at 305-793-8605. We love to hear from you!

Tags: CVC, Newsletter