Thelander CVC Digest: August 2022

Who is Eligible for Incentives Beyond Cash Bonus, which Incentives are Used, and Why CVC Unit Structure Matters?

In August’s Thelander Digest, we give you a sneak peek at our current data from the ongoing Thelander 2022 Investment Firm – CVC Compensation Survey. We explore who is eligible for incentives beyond cash bonus, which incentives are used, and why CVC unit structure matters.

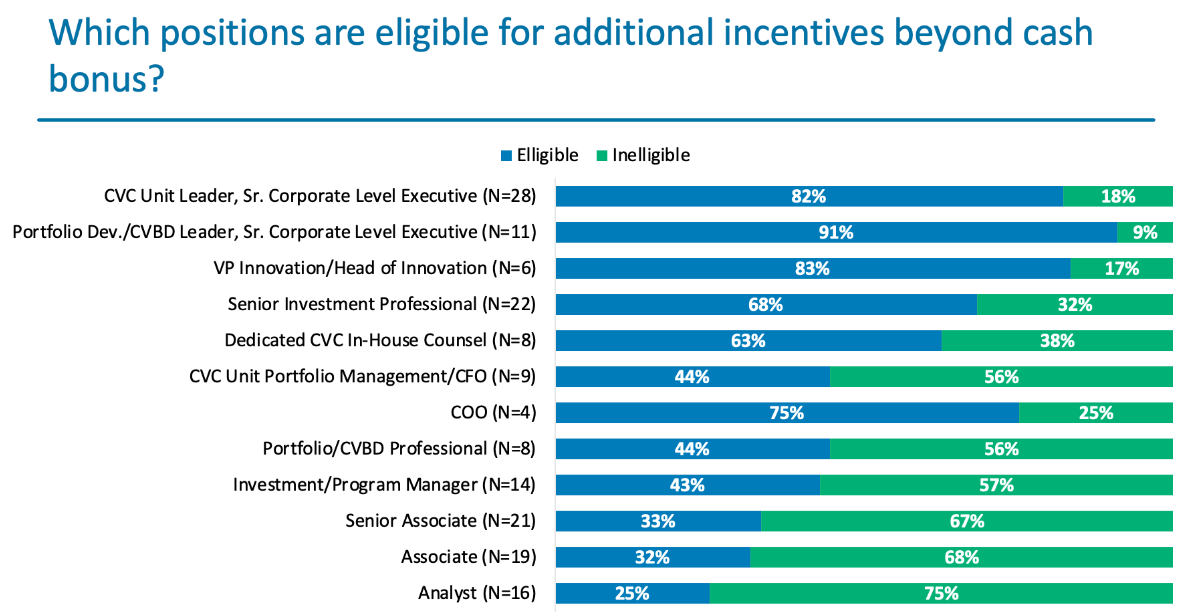

First, let’s look at which positions are eligible for additional incentives.

Thelander data indicates:

- As you might expect, the results so far show that eligibility for additional incentives decreases as you move down the hierarchy of a CVC unit, with the senior corporate level executives and VPs having the most eligibility and associates and analysts having the least.

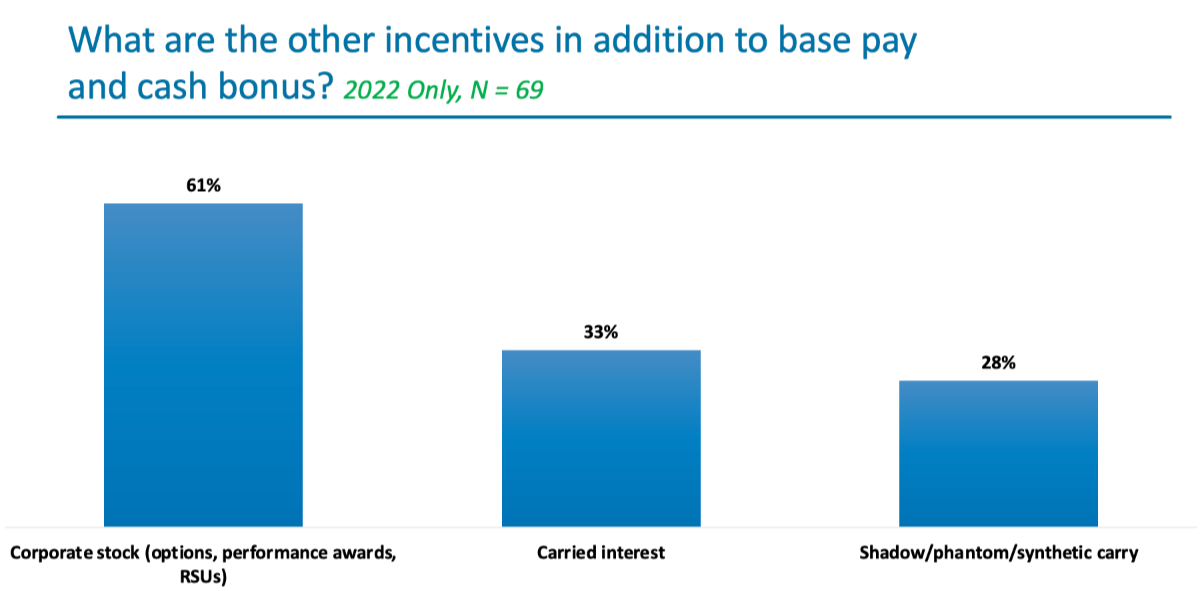

Our data further shows:

- The most common additional incentive beyond cash bonus used was corporate stock (i.e. the granting of shares in the CVC unit’s parent company).

- The second most common was carried interest, as used by VC firms, where a percentage of the realized profits of a fund is paid out to employees after the fund closes.

- The third most common was shadow/phantom/synthetic carry, a bonus pool meant to simulate carried interest without directly assigning percentages of the profits to employees.

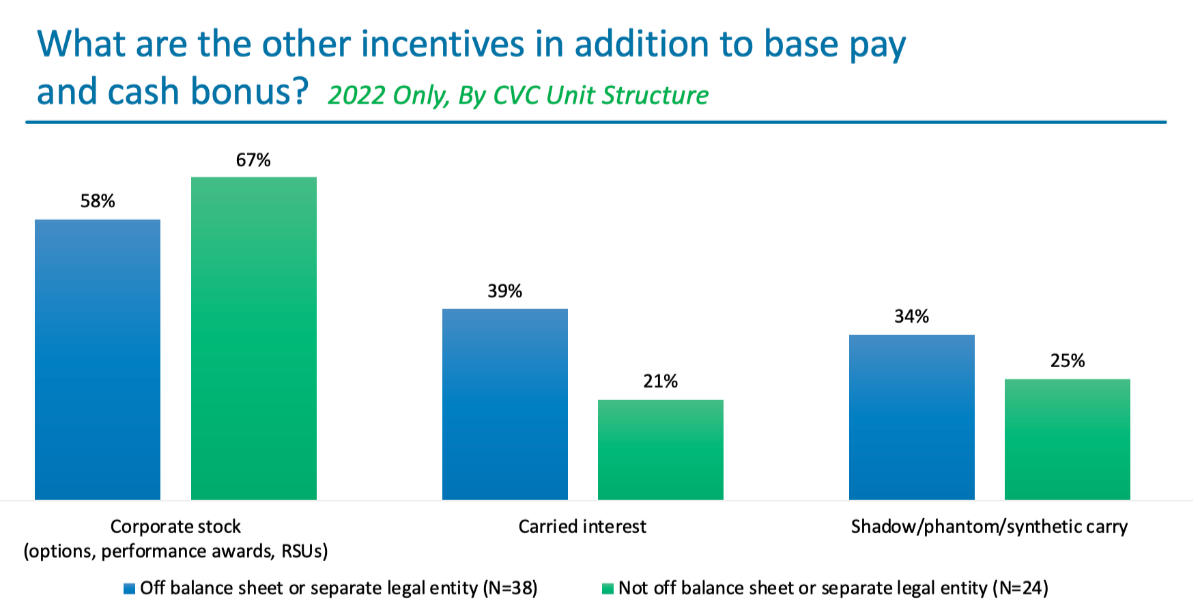

And finally, our data shows:

- The type of incentive used varies according to the structure of the CVC unit. More independent CVC units that are off their parent company’s balance sheet or separate legal entities are more likely to provide employees with carry or shadow/phantom/synthetic carry.

- CVC units that are not off-balance sheet or separate entities are less likely to provide those incentives and more likely to provide corporate stock.

Do you want to find additional CVC compensation data? You can access this and many other topics for FREE by participating in our CVC Compensation Survey.

Thelander is the only firm that covers the entire private capital market from your investment firm to your portfolio company’s compensation. Did you enjoy our Thelander Digest, have ideas for future ones, or want to learn more about how J.Thelander Consulting can help you make informed decisions when it comes to hiring, incentivizing, and retaining talent? Email us here or give us a call at 305-793-8605. We love to hear from you!

Tags: CVC, Newsletter