Thelander PC Digest: July 2022

Which Industries are Seeing the Most Mergers and Acquisitions?

In July’s Thelander Digest, we examine where we’re seeing the most amount of mergers and acquisitions and if industry makes a difference in the likelihood of companies having a carve-out plan in place.

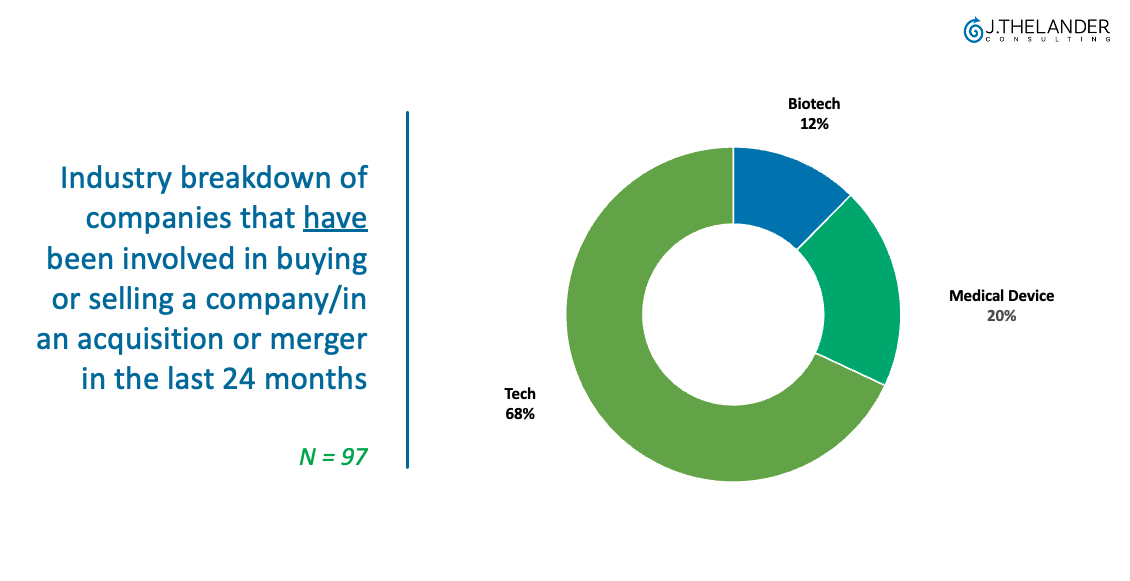

As our data shows in the graph below, there have been more mergers and acquisitions in tech compared to biotech and medical device companies in the last 24 months.

As shown in the charts below, Thelander data further indicates:

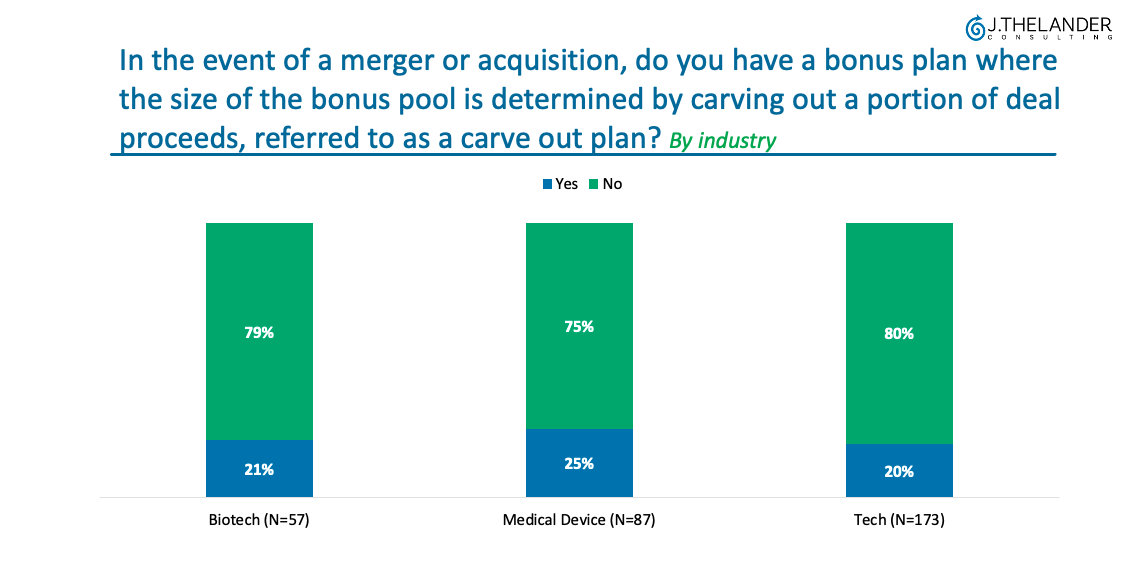

- Despite tech companies being the most prominent in terms of involvement in M&A deals, Medical Device companies actually had the highest percentage of carve out plans in place.

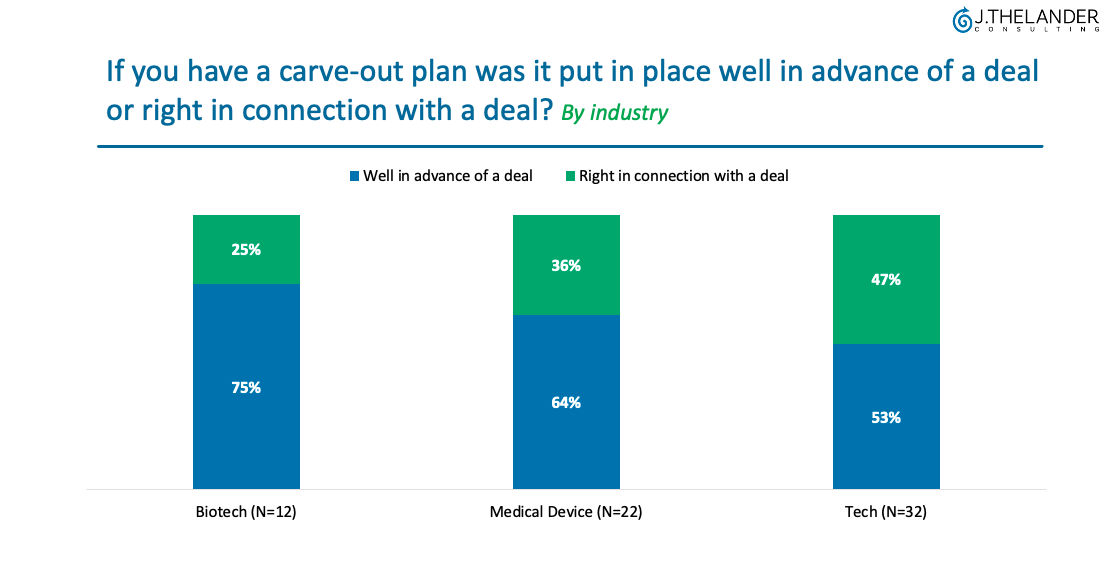

- Tech companies were the least likely to have their carve out plans prepared in advance and biotech companies were the most likely.

- The relative preparedness of biotech and medical device companies compared to tech may reflect the importance of key technical and scientific staff to the continued operations of life science companies.

What is a carve out plan and why are they important? A carve out plan is essentially a bonus given to key employees in the event of a merger or acquisition. The size of the bonus pool is determined by carving out a portion of the deal proceeds. Companies utilize carve out plans to ensure “buy-in” among key employees who hold common stock that may have little or no value in the deal by ensuring them a cash payout. Cash is king!

Did you find this data valuable? You can participate in the Thelander Mergers & Acquisitions, Change of Control, & Severance Survey here regardless of whether you’ve been through an M&A transaction or not! All participants will receive a complimentary overview report with data and analysis on severance, mergers & acquisitions provisions, accelerated vesting, and more. There is no cost to participate and all data is published in aggregate only with NO individual names or company names reported.

Did you enjoy our Thelander Digest, have ideas for future ones, or want to learn more about how J.Thelander Consulting can help you make informed decisions when it comes to hiring, incentivizing, and retaining talent? Email us here or give us a call at 305-793-8605. We love to hear from you!

Tags: Newsletter, Private Company