Thelander IF Digest: July 2022

Compensation Differences: Venture Capital vs. Private Equity Firms

July’s Thelander Digest examines compensation differences between venture capital firms and private equity firms, particularly for lower-level investment professionals.

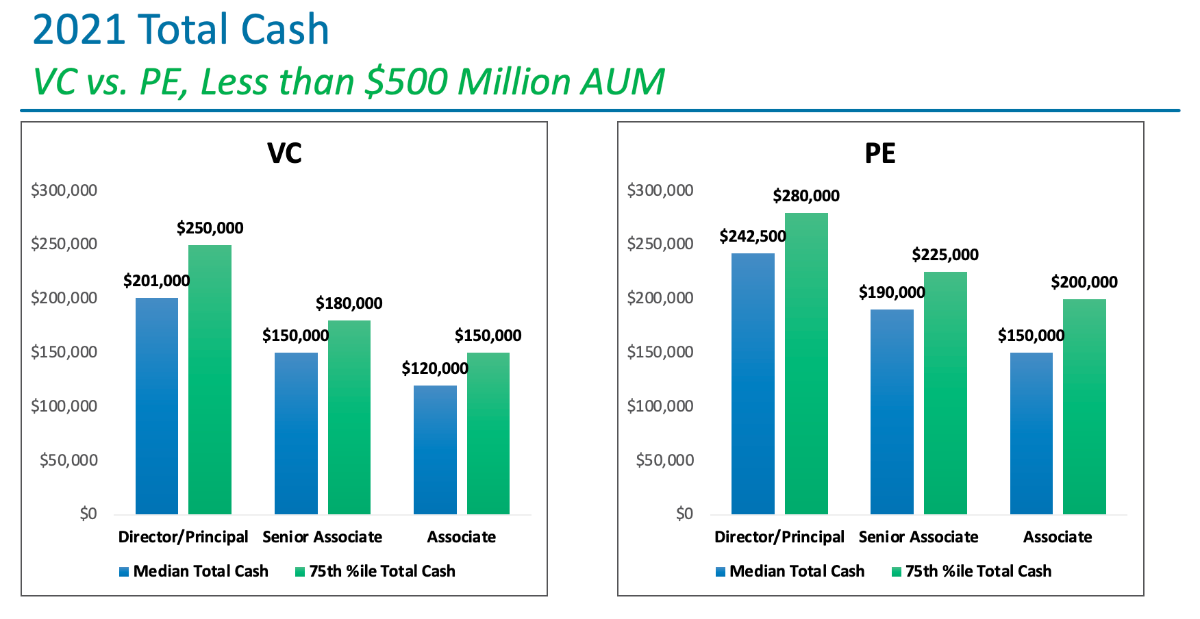

Thelander data indicates:

- At firms with less than $500 Million AUM, Associates, Senior Associates, and Directors/Principals all have higher total cash compensation at PE firms than at VC firms.

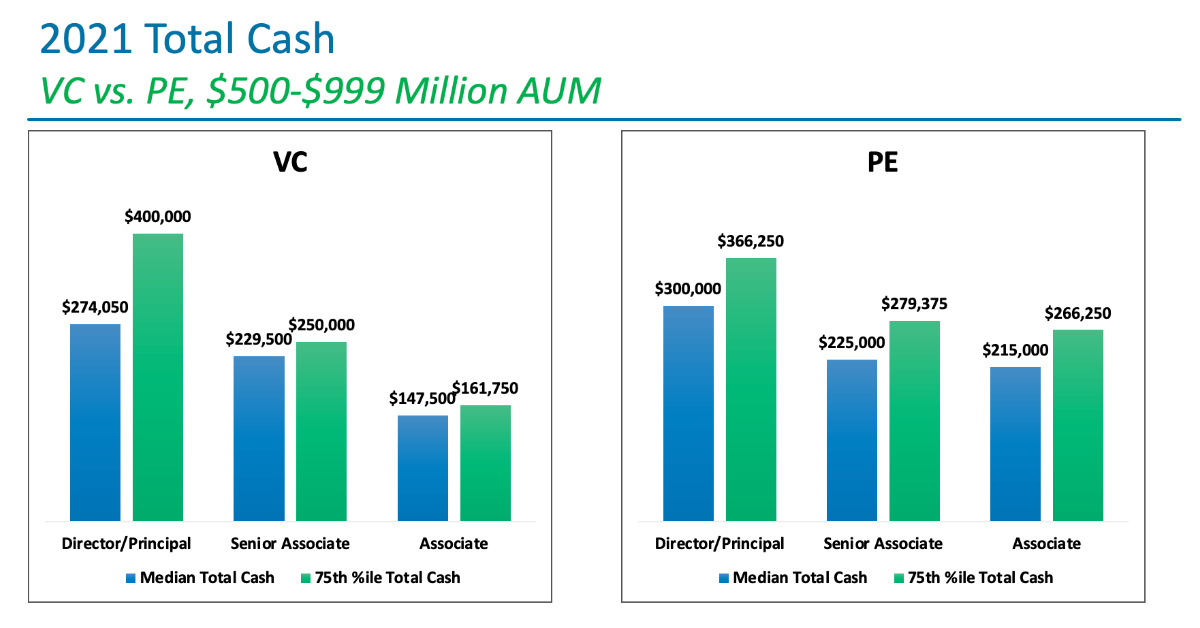

For firms with $500-$999 Million AUM, we find:

- VC and PE total cash begin to get a little closer for Senior Associates and Directors/Principals, with the 75th percentile for Director/Principals at VC firms even higher than those at PE firms.

- For Associates, there is still a large gap between VC and PE.

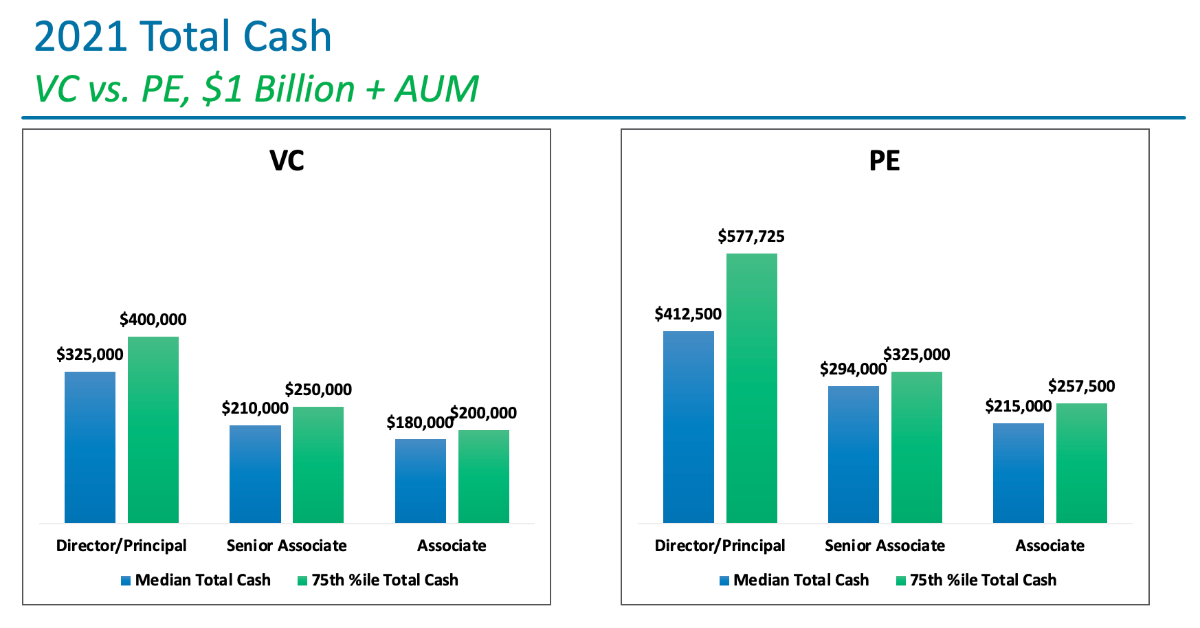

And lastly, at firms with more than $1 Billion AUM, our data shows:

- The gap between VC and PE widens out again, with lower-level investment professionals at PE firms making significantly more, especially at the Director/Principal level.

Do you want to find this data on other investment professionals? You can access this and many other topics for FREE by participating in our Investment Firm Compensation Survey.

Thelander is the only firm that covers the entire private capital market from your investment firm to your portfolio companies compensation. Did you enjoy our Thelander Digest, have ideas for future ones, or want to learn more about how J.Thelander Consulting can help you make informed decisions when it comes to hiring, incentivizing, and retaining talent? Email us here or give us a call at 305-793-8605. We love to hear from you!

Tags: Investment Firm, Newsletter